Practice Area Demand Trends at FLEX in 2025

Practice Area Demand Trends at FLEX in 2025

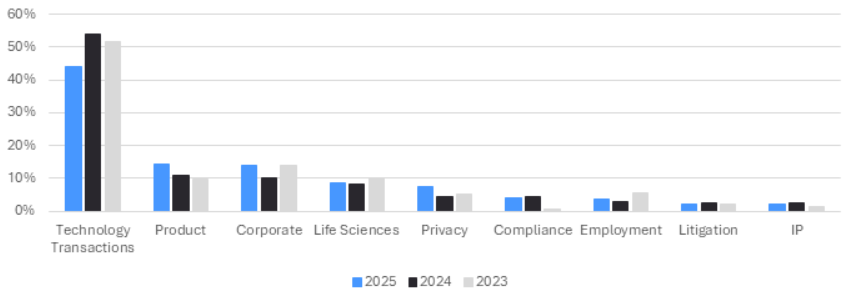

As we reflect on 2025, FLEX’s data on client demand offers insights into how the legal market progressed — particularly for in-house counsel at technology companies. From tech transactions to privacy, product counseling, and compliance, demand shows diversification, specialization, and the continued impact of emerging technologies.

Below, we break down the key trends in the interim counsel market as observed by FLEX last year.

1. Tech Transactions Remains the Powerhouse Practice Area at FLEX

Unsurprisingly, Tech Transactions was by far the largest category tracked in 2025.

Across scaling client demand, companies sought attorneys experienced in general commercial, outbound SaaS, procurement/inbound licensing, supply chain, data licensing, and government contracts.

Key observations:

- Outbound SaaS and commercial agreements remain a staple, showing demand from AI companies, cloud providers, fintech startups, and hardware manufacturers.

- Inbound procurement/vendor management is also strong, particularly in hardware/software-heavy companies, including global tech giants.

- There’s consistent need for hybrid roles blending tech transactions with privacy or product counseling — reflecting the intertwined nature of modern tech legal work.

- Government Contracts expertise is becoming more relevant with defense-tech companies and AI firms exploring public sector markets.

Breadth, tech fluency, and industry-specific contracting knowledge (AI, SaaS, autonomous systems, logistics) enhanced attorney marketability.

2. Product Counseling Demand is Elevated — Especially in Consumer-Facing & AI

Product counsel requests ranked second in volume, showing strong demand for attorneys who can counsel on product launches, safety, advertising, monetization, and regulatory alignment.

Notable 2025 trends:

- AI & content moderation roles at the major global tech enterprises highlight the intersection of product law and trust & safety.

- Fintech product roles among mid-size and scaling startups remained steady, reflecting innovation in crypto, payments, and virtual currency environments.

- Advertising/marketing law continued to be a factor in product counsel roles with consumer-facing platforms.

- Multiple backfill engagements suggest that these roles are valuable and companies attempt to keep product legal capacity steady even during attrition.

Last year, many of our product counsel benefited from having experience in AI risk management, online safety, and/or compliance.

3. Privacy Continues its Critical Role — With Cybersecurity, Health, and AI Overlap

Privacy work was widespread, with roles spanning general counseling, commercial/data processing agreements, health privacy (HIPAA), and cyber incident response.

Key patterns:

- Companies in biotech, healthcare tech, and life sciences drove demand for HIPAA/privacy hybrid attorneys.

- Cybersecurity law expertise is highly sought at companies facing ransomware response, data breach work, and regulatory investigations.

- Many privacy engagements came tied to tech transactions or product — again showing how interdisciplinary tech legal work has become.

Even non-privacy specialists benefited from sharpened skills in data governance, AI privacy implications, and data breach playbooks, as these often surfaced in general tech or product roles.

4. Compliance Roles Expand Beyond Safety — Think Sustainability & Anti-Corruption

While smaller in count than tech transactions or product counsel demand, compliance demand was diverse:

- Safety-focused regulatory compliance for platforms, e-commerce, and consumer products.

- Sustainability compliance in supply chain and tech transactions.

- Anti-corruption and import/export controls, especially for global tech footprint companies.

5. Corporate Law (M&A, Governance, Venture Financings) Holds Steady, But More Specialized

Corporate positions in 2025 skewed toward attorneys familiar with:

- Venture financings in tech startups and VC fund work.

- Corporate governance for rapidly scaling tech companies — including global expansion roles and public company readiness.

- M&A still appears in volume but is heavily industry-targeted toward tech and life sciences.

6. Life Sciences Roles and Litigation

Life Sciences and litigation demand at FLEX remained low last year. Many of our clients with these demands primarily work with outside counsel.

Final Thoughts: FLEX’s 2025 Tech Legal Profile

The FLEX data suggests that the most in-demand tech attorneys in 2025 were interdisciplinary — blending tech transactions with product counseling, privacy, compliance, and corporate skills. Emerging technologies like AI, blockchain, and health-tech created hybrid legal needs that didn’t fit into rigid categories.

FLEX expects to see continued growth in product counsel demand in 2026, including AI-specific product and compliance roles. Additionally, technology transactions demand will remain steady and high across industries involving hardware, SaaS, consumer platforms, adtech, AI, and fintech.

For more information on how FLEX can support your organization, please contact us here or reach out to your FLEX representative.